Shifting Into Gear with Shift4 Payments

A fascinating, high quality business with levers to pull offers a compelling entry point.

Shift4 Payments (NYSE: FOUR) rides the wave of innovative payments processing solutions across a dynamic fintech landscape. Despite consistently robust earnings reports, relentless focus on simplifying customer experience, and strong strategic vision, I believe Shift4 is not being properly understood by the market. Today, we will delve into why this payments business represents an idiosyncratic opportunity, representing durable growth on the precipice of becoming dramatically bigger and more profitable.

This note was originally published to LA Stevens Investments on June 3, 2024.

Share price: $67.28 (as of prior close to 6/3/2024)

52-week range: $42.91 to $92.30 (Low to High)

Market cap: $6.22 billion, based on a fully diluted share count of 92.475 million

Enterprise value: $7.97 billion

The Elephant In The Room: Shift4 Declines a Buyout

In April 2024, Shift4's Founder/CEO Jared Isaacman declined buyout offers among interest from prospective buyers Amadeus Group and Fiserv, au contraire to his longstanding frustrations with respect to the market's pricing. The market was not thrilled with this response, sending Shift4 shares down 27.2% from Q1 highs. Shareholders have experienced a roller coaster ride over the last 6 months, on a related note.

While many are quick to cast doubt regarding the uncertainty of the company's future prospects, there are several tangible reasons why an executive would be concerned with the market's lack of respect:

Depressed valuations relative to private or public competitors directly stymie ability to execute on strategic M&A, which Shift4 has proven to be highly adept in.

A headwind to talent acquisition. A stock's price may serve as a signal of its future viability to prospective customers, employees, and executives.

As Shift4's convertible debts start to mature in late 2025, management would like to have the option to refinance instead of paying down the debt with cash on hand, due to a plethora of reinvestment opportunities. A higher stock price allows most of those debts to convert, resulting in improved capital allocation possibilities.

That being said, every deal only makes sense at the right price, and Shift4's CEO said as much in his explanation from the Q1 shareholder letter:

"The Board received multiple formal offers from strategic parties at a share price premium materially higher than levels at the time of the review and certainly where we are trading presently...price expectations rightfully kept moving up. Shift4 has been a share taking winner throughout our existence...We are structurally setup to win in the verticals we have focused on and that doesn't slow down just because there is a strategic review underway. [...] In short, our customers are the envy of the industry, we are not going to stop growing and it was going to take a big premium to walk away from Shift4".

Shift4 denied these buyout offers from a position of strength because they vehemently believe in their business. This offer was significantly higher than their stock price (very likely triple-digits, given the stock was in the mid $70s to low $80s throughout the bulk of the strategic review process). Isaacman notes major customer wins, their strategic global ecommerce customer, and strategic M&A pipeline/deal - it's quite clear he is bullish on the business, and was not looking for a quick cash-out.

"[The] go private option is usually available and others have clearly shown that...however, the go private option presents clear complexities alongside competing strategic offers. I always want my interests completely aligned with the rest of my fellow shareholders."

Isaacman continues, noting that while he is not opposed to selling the company, he would require a hefty price. Regardless, Shift4 is set up to win in a big way.

"I want to ensure that Shift4's growth and wins are problematic for the competition until such time as they choose to make the problem go away. [...] This is still early days in the convergence of software + payments and we are at the heart of it with a winning approach that leverages our ability to buy, build or partner to succeed...we will deploy capital in a disciplined way with very high returns and when there is not a better strategic use of capital, we will opportunistically buy back our stock with a fresh $500 million authorization."

Furthermore, Isaacman backed up these bullish comments with insider buys of $8.2 million total across May 14 and May 23, 2024. Isaacman owns over 26 million shares with 81% voting power (due to disproportionate class B & C share ownership), demonstrating strong alignment with common shareholders.

All this is to say, Shift4 denied these offers from a position of strength and investors should not deduce any fundamental weakness in the business on these merits. Management is acting in the best interests of shareholders.

From Humbling Beginnings to a Formidable Force

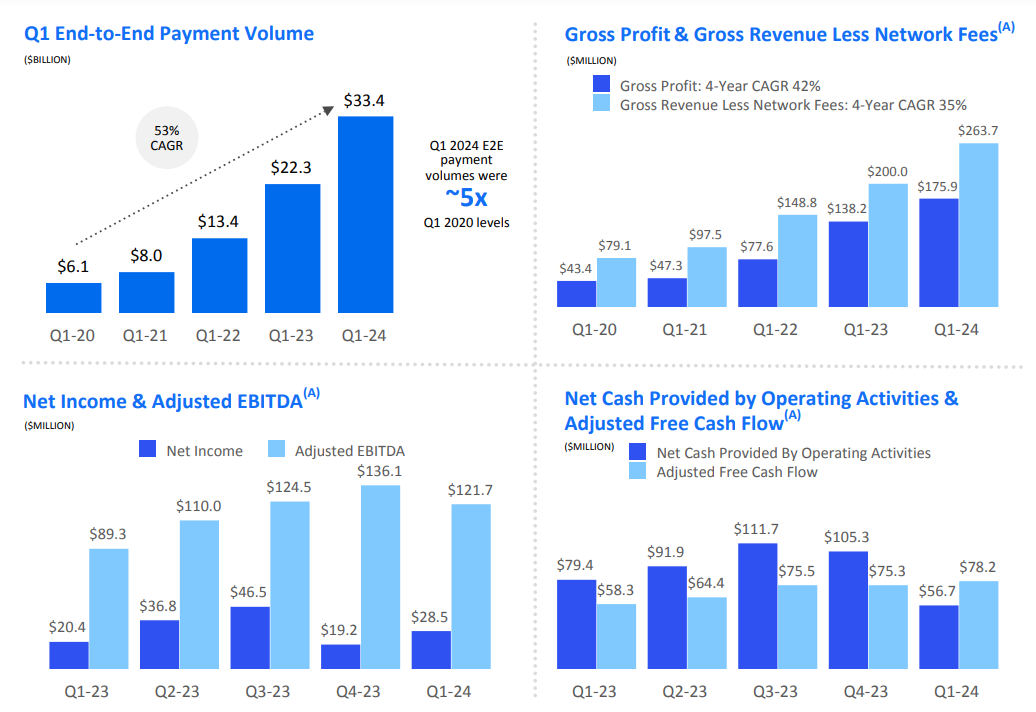

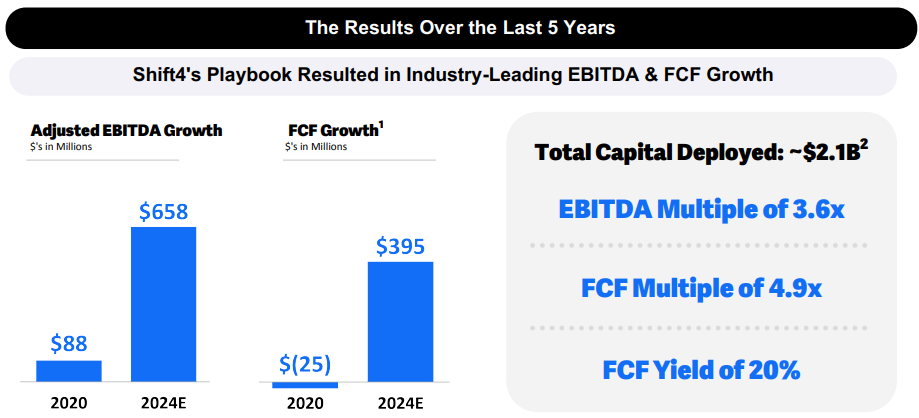

Shift4 Payments is an integrated payments processor and merchant acquirer in the Card Present space, focused on table-service restaurants, hotels & lodging, specialty retail and sports & entertainment venues. Historically, Shift4 has primarily served restaurants (80%+ at time of IPO in May 2020) but has diversified into a roughly even mix of restaurants/hotels today, plus other verticals. The company has grown end-to-end (E2E) volume at 53% CAGR and gross profit at 42% CAGR dating back to Q1 2020 driven by organic growth and product innovation, buttressed by shrewd M&A in lieu of traditional customer acquisition costs. The stock has compounded at 32.2% since IPO, and is now operating at a $1 billion revenue run rate, processing $130 billion in annualized E2E volumes. While only public for 4 years, the company's origins date back 25 years ago, when Jared Isaacman started the company in his parents' basement under the more-mature sounding moniker United Bank Card. Astonishingly, the company has grown payments volume and revenue double-digits each year (through the Great Recession and the pandemic), has had positive EBITDA since 2004, and only started accepting outside money in 2014 about fifteen years after its founding.

The company has gradually moved upmarket, focusing on handling increasing complexity across its merchant base via a portfolio of holistic software integrations, streamlining the customer experience - more on this below.

How Product & Monetization Intertwine

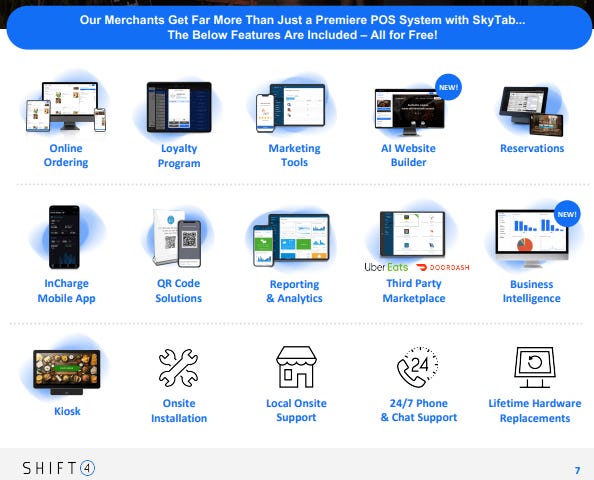

Shift4 primarily monetizes through payments (91%) which arguably carries better characteristics vs SaaS revenue — payments revenue benefits directly from merchant volume growth and price increases while keeping take rates constant. Blended take rates are declining slightly due to customer mix, not pricing degradation: the company has done an excellent job of moving upmarket, resulting in new, major customer wins at lower spreads and higher volumes (currently a blended 62 bps). Through their 500+ software integrations and counting (their website greatly understates progress in this regard as they have noted 600+ integrations for hotels alone), Shift4 is able to consolidate a plethora of legacy systems and enables merchants to provide a frictionless, holistic experience. As integrations add new capabilities, Shift4 will continue to capture more incremental volume within their customers, effectively creating an ARPU story (i.e. capturing ticketing in their stadium vertical, versus only the concessions, team store, parking, etc). In restaurants, Shift4 offers cloud-based Skytab POS systems for free: with a highly competitive offering and superior pricing, this results in a 5-year cost of ownership <30% than that of Toast, their primary competitor in this vertical.

Some examples of their integration capabilities: online reservations, mobile ordering & payments, Uber Eats/Doordash app integrations at a restaurant; front desk, concierge, reservations, valet, restaurant/bar, coffee shop, golf course, salon at a large hotel; ticketing, parking, concessions, team store at an entertainment venue. At sports stadiums using Shift4, fans can order food and drinks through their phone and have it delivered to their seats.

Shift4's Competitive Advantages

Shift4 exhibits several key economic moats & points of differentiation we will discuss today:

Shift4’s deep and growing portfolio of software integrations gives them a right to win, particularly in their verticals with high complexity. This makes it difficult for customers to rip & replace when in many ways, the operating system of their business is being run on Shift4. This is certainly not the case for the legacy players they are displacing, many of which are simply providing an approval or decline, or payments processing without any additional integration capabilities. This results in...

High switching costs or embedding moats

Scale moats - For competitors to replace, they need to compile the necessary software integrations, which in complex verticals has taken many years to intermediate (and a growing hurdle, considering Shift4's internal innovation).

Network effects - We are observing a growing network effect among their Sports & Entertainment vertical customers, where customers without Shift4 are demanding Shift4's services as it allows them to integrate in-seat ordering. This has resulted in a virtuous cycle of recent marquee customer wins, including the Kansas City Chiefs and Chicago White Sox. The effect of being in the pole position? Adding on ticketing processing, the crown jewel of the sports and entertainment vertical.

Exceptional Vision & Execution Results in Strategic Levers to Pull

Shift4 management demonstrates exceptional vision and since being public have proven tremendous capital allocation abilities, and they show no signs of stopping.

A brief summation of what they have done:

Raised $1.69 billion of capital at a 1.35% blended average interest rate during ZIRP, which provided them the capital to invest & diversify aggressively from restaurants; this debt is due in three tranches starting in Dec 2025, though the business produces enough cash flow to pay this down.

Repurchased 6% of shares outstanding at $52.41/share

Strategic M&A to expand internationally (Finaro), cost-effective customer acquisition (FocusPOS, Revel), and entrance into new verticals/acquiring marquee customers (SpotOn S&E, VenueNext, The Giving Block)

Begin to execute on gateway conversion, which sunsets legacy gateway connections and starts processing payments at 4-5x the gross profits. This started gaining traction in 2023 and will continue as they work through the gateway volume stack.

Below are their various strategic levers for growth in FCF per share:

Organic customer wins, across each vertical

International opportunity: Europe, UK, and Canadian expansion

Strategic M&A opportunity: large pipeline of targets at attractive valuations; revamp business model of targets to re-focus on payments, thus increasing free cash flow

ARPU opportunity from existing customers, as software integrations are added and contracts gradually renegotiated

Gateway conversion opportunity: 4-5x gross profit uplift vs existing on $500+ billion volumes by processing payments; additionally, operating leverage and ROIC increases due to favorable customer mix and less opex expended in proportion to revenues

Buybacks: Approved a $500 million share repurchase program, which accounts for 8% of all Class A & Class C shares.

Valuation Analysis

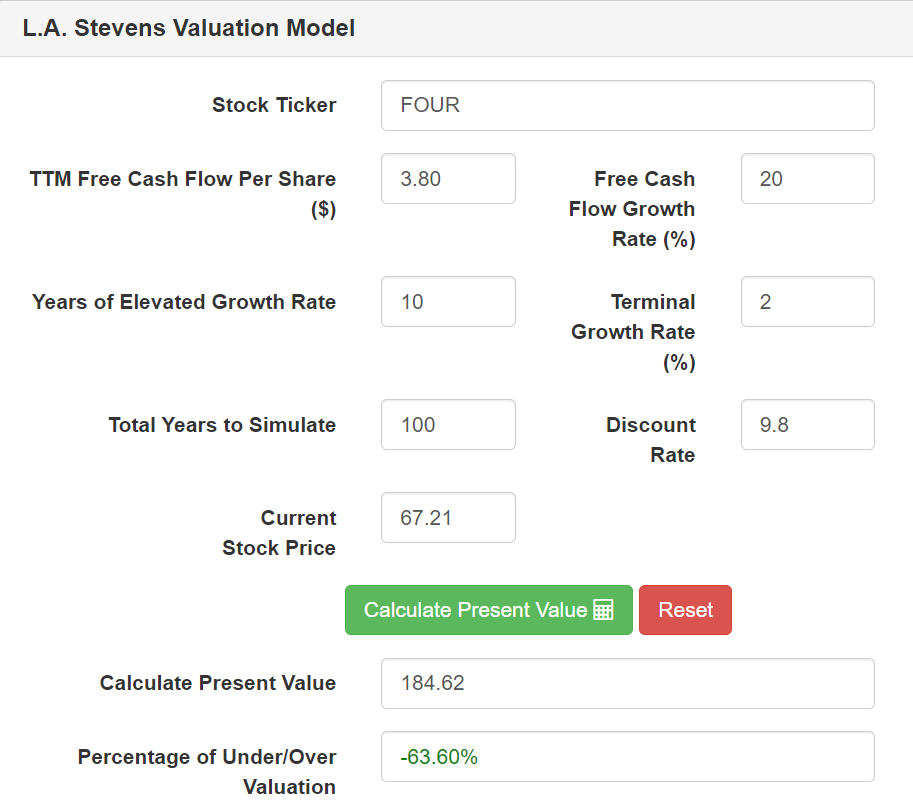

Now turning to the valuation of the business, Shift4 trades at $67.21 with 92.475mm fully diluted shares outstanding, implying a market cap of $6.22 billion and an enterprise value of $7.97 billion.

For a deeper understanding of the potential outcome, I will run the shares through the L.A. Stevens Valuation Model, starting with Shift4's trailing 12-mo revenues of $1,004.1mm and 35% normalized free cash flow margins (vs the company's FY24 updated guidance of 30% at the top-end). I expect further margin expansion as a result of scale and gross profit uplifts from gateway conversions over time. We used a conservative 20% free cash flow growth over the next 10 years, which incorporates both strong organic growth (particularly international) and proven execution in strategic M&A significantly.

Still, we end up with a fair value today of $184.62, implying Shift4 is undervalued by nearly 64%.

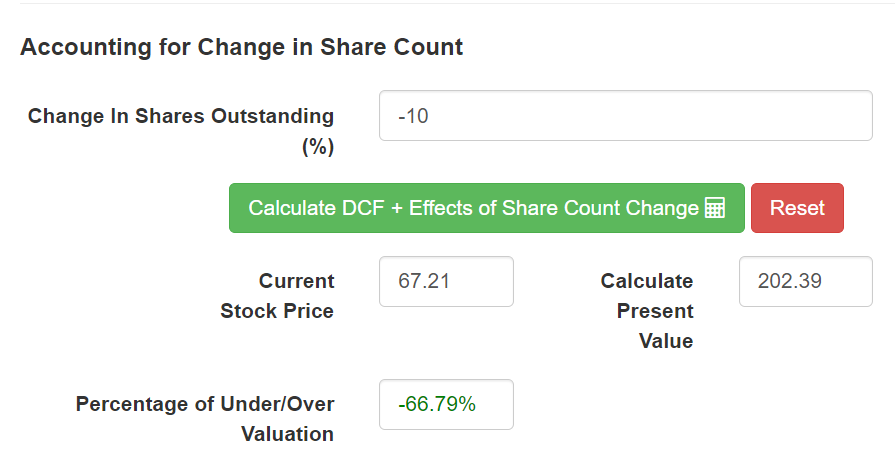

After accounting for the net impact of buybacks over the next 10 years of reducing the share count by 10% (or 1%/yr - again, a conservative estimate), the present value increases to $202.39.

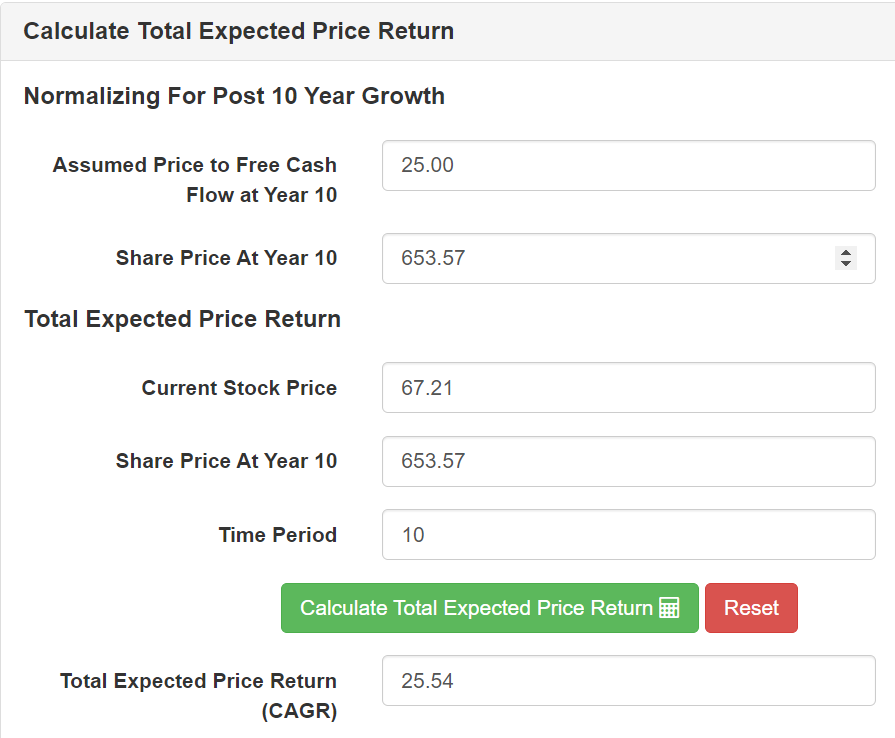

If we consider the terminal multiple at 25x free cash flow, the share price in 10 years projects out to $653.57, or an expected share price return of 25.54%.

Using a more conservative 20x free cash flow or a 5% yield still results in a healthy return profile.

Conclusion

Shift4 is rapidly maturing as an enterprise and is quickly approaching a watershed moment for its business as it goes upmarket and international. While the payments landscape appears to be commoditized, this processor has no problem standing out, using its combination of software & payments to rise above the rest. Coupled with highly adept management, a visionary leader, strong internal innovation and consistent proven results, Shift4 Payments looks to be a business to own for the long term.

As an addendum: In a recession scenario, there may be temporary weakness as volumes decrease, but the company caters to the higher-end consumer and should be impacted less, as well as buoyed by international growth, new customer wins, and wallet-share gains within key verticals.

If you enjoyed this post, please consider showing your support by subscribing to the newsletter and sharing this note with others who may find this information valuable. Thank you!

Disclosure: I am long FOUR.

The contents of this newsletter do not constitute a recommendation for trading or investment advice. Any estimates or forward looking statements made are inherently unreliable. Readers should do their own due diligence and consult their registered investment advisor or financial advisor before making any investment decision.

Double check your work. card connect says otherwise.