Twilio: The Pendulum Swings Both Ways

Twilio stock is completely untethered from fundamentals, presenting opportunity. A deep dive into this polarizing enterprise.

Twilio (NYSE: TWLO) remains the dominant, category-defining CPaaS player with $3.6 billion in TTM sales, up 8x or 59% CAGR since 2017.

The company has strong leadership, a fortress balance sheet, a recurring customer base, and ample margin expansion opportunities as a result of scale.

They will be free cash flow positive in '23 — I estimate 7% FCF margins on $4.77b in revenue, which would translate to 18.6x EV/2023 FCF.

Decelerating growth, lack of current profitability, high dilution, and poor communication with the street has shareholders running for the hills in a rising rate environment. As a result, the stock is deeply out of favor and disconnected from its fair value.

Why I believe Twilio is a ‘fat pitch’ with major long-term upside (including the math behind it).

Share price: $49.25 (as of 11/18/2022)

52-week range: $41.00 to $297.99 (Low to High)

Market cap: $9.1 billion

Enterprise value: $6.1 billion

Company Overview:

Twilio was founded in 2008 by longtime CEO Jeff Lawson, Evan Cooke, and John Wolthuis to drive better customer engagement. The company’s mission is to “unlock the imagination of builders”, which is apt considering their CPaaS (Communications Platform as a Service) offerings are usage-based and grow in tandem with their customers. Twilio’s staggering scale, while still being in its adolescence, is a testament to its resounding product-market fit and its unparalleled reach among its peers: the company touts over 280,000 customers and nearly $4 billion in sales across 180+ countries.

So, beyond the jargon, what does the company actually do? Odds are, you have used their communications services API’s (application programming interfaces) without even realizing it. The B2B CPaaS vendor powers SMS status updates for Uber rides, Doordash orders, and Airbnb host confirmations; SMS for 2-factor authentications, including for Stripe; voice-calling functionality for MercadoLibre’s customer support team; personalized emails for Glassdoor job seekers and employers, among many others. It may seem simplistic or unimpressive, but to Twilio’s customers, these touchpoints are crucial to gather data from or inform their end customers. This leads to a much-improved customer experience, driving higher customer engagement, higher customer satisfaction and NPS (net promoter score), and increased repeat business, resulting in higher customer lifetime value. These offerings are mission critical and sticky, and their core messaging product forms the base of an effective land-and-expand strategy, from which the company can cross-sell other higher margin offerings such as voice, email, video, or software.

“When you’re talking about deliveries in one hour or less, there are a series of events that have to happen. Often there will be an order coming in just when we’ve finished a previous order--so it could be only one or two minutes after you place your order that we’re picking things off the shelf. That wouldn’t be possible without Twilio because we send a text message to our shoppers which notify them when to start. And we have optimized that time between when they get that message and when they actually start--we know how long it takes, in seconds, for an in-store shopper to acknowledge an order and pick the first item. These are critical metrics to us; efficiency equals economic viability in our business.” —Max Mullen, Co-founder of Instacart

This is further evidenced by a 122% dollar-based net expansion rate in Q3, which shows existing customers spending +22% y/y despite tough comps from the pandemic-boosted comparison period. Whether qualitative or quantitative, the firm’s value proposition continues to endure. (Note: dollar-based net retention is not reported since event-driven customers, namely elections, are seasonal/biennial and would add noise to the data; DBNRR includes customer churn while DBNER does not).

Twilio CPaaS/Messaging:

As mentioned earlier, the company is best known for its CPaaS suite which makes up ~86% of their sales at ~47% gross margins. Messaging carried a 33% margin in Q3 (~50% GMs in US vs ~23% internationally).

The margin profile on messaging is poorly understood by investors as it has optically decreased over time. This can be attributed to a higher international mix (faster growth vs domestic, carrying lower margins) and increased domestic carrier fees to transmit SMS, which are passed through to their customers at cost. On a per-message basis, margins are actually stable or increasing.

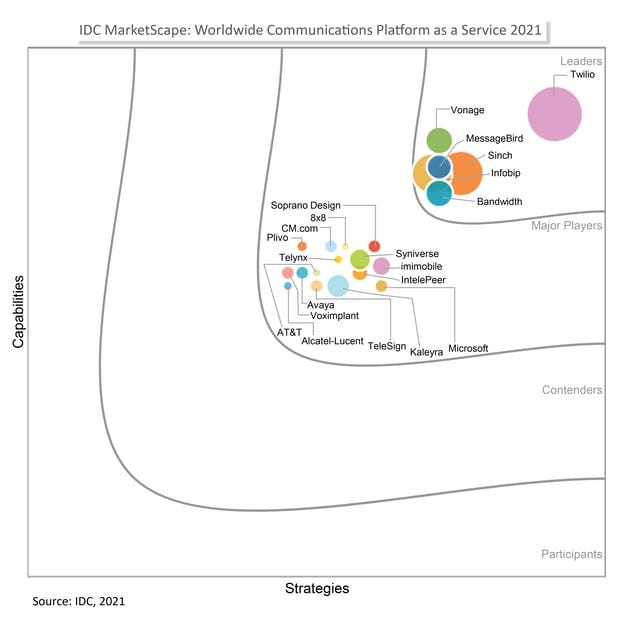

Twilio is meaningfully ahead of its peers in both its revenue base and its capabilities, as illustrated by industry research below. In 2021, they outgrew the CPaaS market by ~2500 bps (55% vs 30%, per IDC). The company estimates the global CPaaS market to grow at 10.6% CAGR through 2025—with an overall 20% revenue guide at the midpoint, which strikes this author as sandbagging in light of a temporarily weaker macro environment. Given this, I believe weaker players will be flushed out and tuck-in M&A will improve industry dynamics over time.

While competitors are forced to optimize for maximum profitability now, Twilio is in the enviable position to be opportunistic and reinvest into growth to further accelerate their lead—using messaging as the wedge from which to land and expand. I should note the lack of profitability is intentional and strategic: Sinch (SINCH.ST), Bandwidth (BAND), and Kaleyra (KLR) are publicly traded and have become free cash flow positive recently. If they were not reinvesting its gross profits to finance its nascent software business, I believe Twilio could generate at least 15% free cash flow margins today.

Twilio Software: Building a Customer Engagement Suite

Twilio’s software businesses are at a $416 million ARR (annualized recurring revenue) with 79% GMs, which alone are enough to justify the company’s enterprise value. Of this, Segment (its customer data platform, or CDP) makes up ~$262 million ARR and has grown at an 81.9% CAGR since acquired in Q4 2020. Flex (a virtual contact center, or CCaaS) launched in 2018 and is now at a $100+ million ARR, with two consecutive quarters in which an eight-figure (>$10mm+) ARR deal has been signed. The software vendor should see increased uptake in its higher-margin offerings over the coming year, having revised its go-to-market strategy and restructured its sales incentives in Q3.

While neither Segment nor Flex will move the needle near-term given the large relative size of the CPaaS business, both present compelling cross-sell opportunities to (1) synthesize and interpret their customer data to make higher ROI customer acquisition decisions and (2) streamline the customer service experience by increasing speed of service for the end customer and reducing friction for CS reps. Twilio’s initiatives to focus on these product lines, with compelling value propositions in greenfield spaces, give me increased confidence that their software sales can grow at high rates for a long period of time.

Twilio Software: Segment

It is easy to overlook the massive opportunity for customer engagement software, so here is some helpful context. The global sales for Customer Data Platforms (such as Segment) are expected to grow 34% through 2027 (Research and Markets), 15% through 2028 (AbsoluteReports), or ~20% through 2025 (IDC) from a 2022 base of $2 billion (Statista’s estimate). Segment’s $262 million ARR implies 13.1% market share, which is up ~290 bps from 2020 and makes them an early leader in the space.

Segment ranks among the top CDP’s by customer satisfaction and market presence alongside Bloomreach, Klaviyo, and Insider, according to G2 (see below grid). Treasure Data and Tealium, the #2 and #3 players by market share, are in the top right quadrant but not among the leaders. They are the blue diamond tile and the teal tile directly diagonal to the blue diamond, illustrating that Segment has the biggest scale and the most momentum.

Note: Salesforce, Oracle, Microsoft, Adobe, and SAP have CDP offerings, but they do not have meaningful market share yet. I expect each to grow over time, and I see their entrances as validation of the large market opportunity rather than an imminent threat.

All of this begs the question, what is the necessity and significance of a CDP? For one, Salesforce estimates that 71% of end customers expect personalized interactions, yet the average business has 976 unique applications! Manual integration is not feasible due to high IT costs, data security concerns, and compliance requirements, yet the need for a B2C company to deeply understand its customers in real-time is the bare minimum to stay relevant.

Of the organizations that have integrated user experiences, more than half said it had enhanced visibility into operations (54%) and increased customer engagement (54%). Other benefits realized included innovation (50%), improved ROI (48%), and increased automation adoption (45%). —MuleSoft 2022 Connectivity Benchmark Report

Enter a CDP.

In a nutshell, a CDP aggregates first-party customer data from each siloed application (for example, CRM, Facebook, Google Ads, Shopify Marketplace, HubSpot, etc; Segment boasts over 400 pre-built integrations) and pieces together a holistic view of each customer. This view can be used to segment (get it?) based on data characteristics and used as the basis to market to each of these customers at a personalized level, ultimately driving higher conversion, satisfaction, and customer lifetime value. Below is that same explanation in pictorial form. Here is a Segment demo for those curious.

Between mounting public concerns over data privacy and increased difficulty in tracking customer behavior outside of first-party applications (due to newly-instituted IDFA standards), companies have a greater need than ever to understand their customer data on a deeper level. There is convincing reason to believe that customers who are late to adopt will be left behind and that this industry is at the very beginning of a multi-decade growth trajectory.

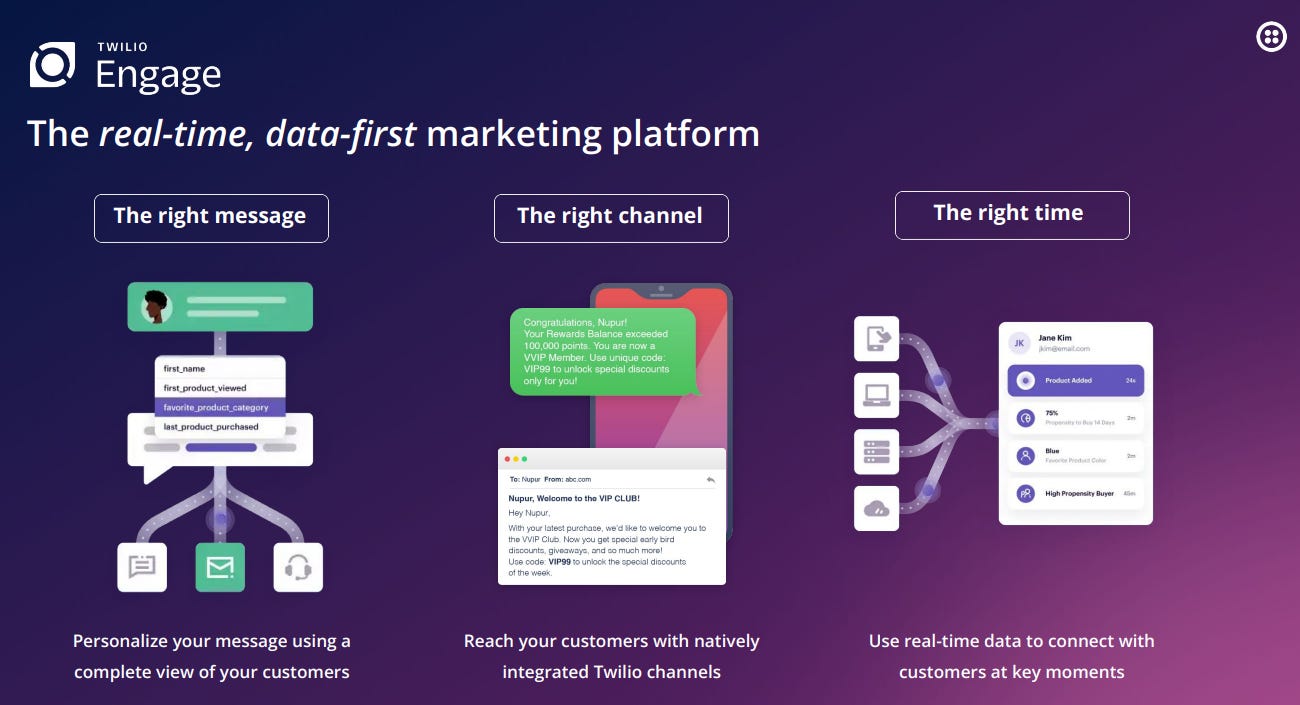

Twilio Software: Engage

Launched two weeks ago, Twilio Engage sits on top of Segment to provide “automated personalization at scale”. I am cautiously optimistic and view this as an embedded call option. Even though the company has been working on Engage for quite some time, they have kept this project under wraps and little information is available, save for a press release, Investor Day presentation, and several short YouTube videos. Given Segment’s reputation for ease of use, Engage should offer a similarly good user experience with a higher-level functionality—though truth be told, it’s unclear exactly what that functionality is, because the company is so tight-lipped.

Twilio Software: Flex

Twilio Flex is a Contact Center as a Service (CCaaS) business—a sector expected to grow at 17.5% CAGR from $4.9 billion to $15.1 billion in 2029, according to Fortune Business Insights. The need for these virtual contact centers is driven by the need for customer service representatives to be able to handle all types of inbound requests (SMS, messages, live chats, emails, social media channels, and phone calls) in one streamlined system to save on cost and improve the customer experience. Growth in the sector is expected to be driven by cloud, API-based offerings, which can be customized based on the company’s needs.

Twilio isn’t a leader in this space by any means—its competition includes Genesys, NICE, AWS, Five9, and Vonage, among others—but it is starting to find some acceleration, with two consecutive quarters of $10+mm customer wins. Like Segment, I expect Flex to benefit from the refocused sales strategy. Cross-sell will be key.

Moats: A Lot to Like

From messaging to software, Twilio’s entire product suite is deeply embedded within their customers, resulting in high switching costs. It does not make economic or practical sense to change vendors unless there are excessive price increases or deterioration in service reliability, as switching itself would result in an extended interruption to the business.

As a result of success in its messaging business, Twilio has been able to build out its business geographically (operating in 180+ countries), its CPaaS suite, and now its customer engagement software offerings. This has led to a high scale moat, with competitors unable to match the breadth and depth of their offerings. As customers scale their business in new geographies, Twilio already has the relationships with telco providers and compliance infrastructure to support. As customers desire higher-value customer engagement tools, Twilio is there. Competitors cannot say the same.

As the first-mover and largest player in messaging and CPaaS, the company has defined the category and has developed a strong brand moat to show for it.

I see no network effect here: While the land and expand strategy has worked nicely, each offering does not incentivize the use of another (Segment & Engage notwithstanding, the latter of which is in its infancy, if that). Customer adds could spur adoption within a particular category, though that would not be necessarily unique to Twilio (i.e. Segment adds pushing those customer’s competitors to adopt a CDP).

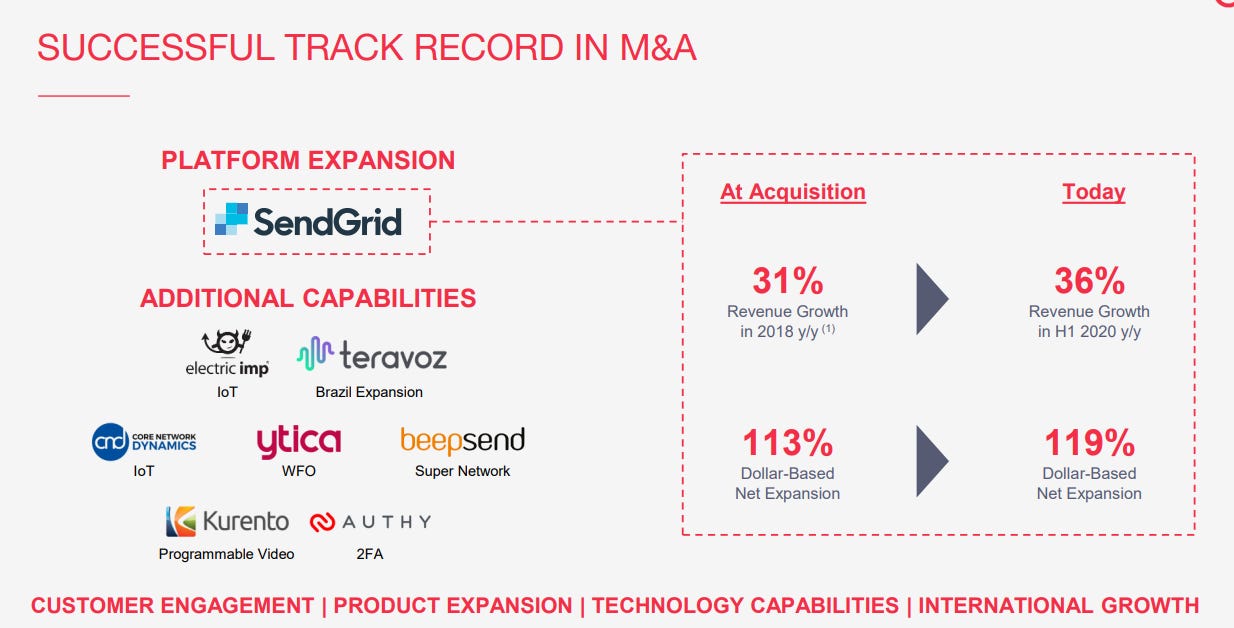

Capital Allocation: Remarkable!

Twilio has a long, admirable history of tuck-in M&A used to expand its capabilities. Most notably, SendGrid, a leading email API business ($2.8 billion in 2019), Segment ($3.2 billion in 2020), and ZipWhip, a toll-free messaging business ($850 million in 2021). The company also took a $750 million minority stake in Syniverse (2021), a telco, which presents cost synergies on messaging. Other deals have not been as material (<$30 million in size).

Twilio has done an excellent job using its stock as currency when expensive. In addition to the above transactions, the CPaaS vendor raised $1.54 billion in equity at $443 per share in Feb 2021 (where the stock traded north of 35x EV/S). SendGrid and Segment were all-stock, and ZipWhip was paid for half in stock, half in cash (which will be sunset next year). Today, the company’s stock trades at $49.25 per share and a $6.1 billion enterprise value, which means they have paid out more in stock for acquisitions over the last 3 years than the entire company is worth, excluding cash. This is despite SendGrid and Segment playing an instrumental role in the company’s future and the core business continuing to strengthen.

Today, the company has $4.2 billion in cash & equivalents and $1 billion in debt (at 3.8% interest) which matures half in 2029, half in 2031. While not cash flow positive yet, the 11% reduction-in-force done in September and the switch to a remote-first workforce set them up to produce free cash flow as soon as Q1. While management has cited tuck-in opportunities to justify holding these levels of cash, the best way to create shareholder value is to buy back shares at these depressed levels.

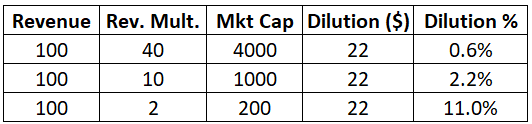

The one stain on this record is dilution from stock-based compensation, which represented 22% of revenue in Q3. Most tech companies run high dilution. Twilio is on the extreme end of the scale, and this is magnified even more by the valuation compression shareholders have experienced. For most of their corporate history, the company traded north of 10x sales, so dilution was not an issue. Now it is.

On balance, I tend to agree with Morningstar’s Exemplary capital allocation rating, though it is imperative for the company to step in and defend the stock, given its financial profile.

Other Considerations:

Strong company culture: Despite the major stock price decline (nearly 90% off highs) and 11% layoff in September, Twilio’s internal culture has remained strong. According to Glassdoor, 81% of employees recommend working at the company to a friend, and 88% approve of founder/CEO Jeff Lawson.

No customer concentration: No outsized exposure to a single customer or industry.

Mixed leadership: CEO Jeff Lawson has done an excellent job taking Twilio from zero to one, building a company to last. Executive turnover in key seats is cause for concern: former COO George Hu, who left in Oct 2021, was a big loss. Former VP of Revenue Marc Boroditsky left in Aug 2022. In response, Twilio promoted their CFO Khozema Shipchandler to COO/CFO (a questionable decision, given the scale of the business) and brought in longtime board member Elena Donio to lead the sales front. While it is too early to definitively adjudicate, the firm does need a dedicated COO with an operations background to run the business more efficiently.

Insider Ownership/Lawson’s Voting Rights: Lawson owns 6.48 million shares (3.6% ownership) or $319.1 million, which does not include any unvested options. Most of this comes from his Class B shares, which give him 58.4% of voting rights. These voting rights expire on June 30, 2023, fueling speculation Twilio could be a target for activist investors or a private equity buyout.

The Math Works and Then Some:

To add some context around what a fair value should be today and what potential upside might look like over the next 5-10 years, I built a 10-year discounted cash flow model with my growth and margin assumptions. In my eyes, there is tremendous operating leverage within the business as software investment will continue to result in elevated software growth (driven by Segment) along with higher-margin focus in the core CPaaS business (which I have not modeled for). My model calls for 20% growth CAGR for CPaaS and 32% CAGR for software, stable margins by category, and a higher software mix driving GMs higher to 53% by the end of the forecast period. I believe Twilio will continue to take share in messaging, CPaaS, and Segment, with optionality present in Flex and Engage. This means revenue would go from ~$4 billion for 2022 to ~$26.7 billion in 2032, with gross profit growing at a slightly faster clip.

I penciled in 35% CPaaS growth in 2024 due to an economic rebound, a percentage that would be similar to what they have done through Q3 YTD.

I have operating expenses forecasted to improve by an average of 225 bps per year and assumed a 22% tax rate. The company has just under $1 billion in remaining debt at 3.75% interest (blended), with half due in 2029 and half in 2031.

High customer retention reduces the need for S&M and the company does not need meaningful headcount growth, thus reducing G&A and stock-based compensation as a percent of revenue. While there will be continued iteration, R&D can be curtailed as the CPaaS and software suites are finally fully developed. This aligns with the company’s view as well. They believe they can get up to 300 bps of margin improvement over the next 3-5 years with additional margin gains thereafter, so while this may seem like an aggressive forecast, this makes a lot of sense given the business model.

After adding back noncash expenses (SBC and dep./amort.), I forecast 7% free cash flow margins for Twilio in 2023 ($330 million), which increases to 25% in year 10 ($6.8 billion). Factoring in a 10% discount rate, 3% terminal growth, 15-20% dilution per year, and assuming all new shares are issued at $60, I arrive at a $93.24 fair value today, which is 89.3% higher than the current stock price.

Set to produce $330 million in FCF next year, Twilio’s implied EV/FY23 FCF of 18.6 seems absurd considering how far they are from terminal FCF margins:

To think about long-term upside, I took the 2032 FCF figure and extrapolated what the stock price would be across different exit multiples and shares outstanding. For what it’s worth, I project 558 million shares outstanding in 2032, though this assumes no buybacks (very unlikely) and all new shares are issued at $60 (also very unlikely). Still, this would yield some very positive results, despite the heavy dilution.

At 30x FCF and 550 million shares outstanding, the stock would be worth ~$375, good for a 22.5% 10-year CAGR or nearly an 8x with further upside if they buy back shares with their hefty cash position.

Risks/Why This Opportunity Exists:

If you’ve made it this far, you’ve probably looked up the all-time stock chart (overlays with EV/S below) and are wondering why it forms a perfect bell curve. Twilio’s steep drawdown is not unique—most growth tech stocks are down between 60-90%, a product of accelerated sales growth and extreme overvaluation during zero interest-rate policy—but there are other fleeting, idiosyncratic issues at play here that will be resolved soon.

Loss of investor confidence: Forward growth (guided for 20% CAGR over next 3-5 years, at midpoint) will pale in comparison to historic growth (59% CAGR over past 5 years), which has shaken out hypergrowth investors. The company does not produce free cash flow presently, which precludes GARP investors or value investors from seeing the opportunity. Following Q3 earnings, several hedge funds who had owned the stock are suspected to have been forced sellers, increasing the drawdown. Twilio is temporarily stuck without a shareholder base.

High shareholder dilution: This is egregious dilution, especially given where the stock trades. Should the stock continue to trade around the current sales multiple, shareholders will be diluted by ~9% per year. I view this as the biggest risk. While I expect SBC as a % of revenue to gradually reduce in coming years, prospective shareholders need to accept that this is not a one-time issue.

Poor communication with analysts: The company had several surprises for the street at its Investor Day three weeks ago, primarily medium-term margin targets (+200 bps/yr at the midpoint) which were lower than expected, with no margin improvement outside of the 11% layoff in 2023. They decided to exit the political messaging business, citing a poor experience for the public and harmful reputation to their brand. The company did not provide long-term (5+ years) margin targets and pulled the prior 30% revenue growth target.

Lack of free cash flow or earnings: Self explanatory. The company burned $35.1 million in cash in Q3 and guided for a $10 million cash burn in Q4, after which we should see positive FCF and non-GAAP operating income. Note that Q3 GAAP results are impacted by one-time expenses in restructuring costs related to layoffs ($72.5 million) and impairment of real estate leases related to transitioning to a remote-first workforce ($97.7 million).

Macro impact: The usage-based company posted 32% y/y organic growth in Q3. Management started seeing a broad slowdown due to macro and specifically noted end markets for social media, crypto, e-commerce, and retail.

New go-to-market strategy: There are no guarantees of success with any new sales strategy. It does illustrate a shift from customer acquisition (for messaging) to cross-selling higher-margin products to existing customers.

“Risk” of buyout: With the CEO’s voting rights expiring in 8 months, activists are likely to build up large positions and push for major changes or a buyout. In my eyes, a buyout would cap shareholders’ upside at a fraction of the company’s long-term value.

Takeaway:

I believe Twilio is a high-quality business that offers a large short-term dislocation and a long-term opportunity at current prices. While the market was only concerned with revenue growth in 2020-2021 and GAAP profits/dilution now, what ultimately drives long-run stock prices is free cash flow per share, of which the company is poised to produce in spades for many years. Twilio is entering its second act, and the best is yet to come.

Disclosure: I am long TWLO.

The contents of this newsletter do not constitute a recommendation for trading or investment advice. Any estimates or forward looking statements made are inherently unreliable. Readers should do their own due diligence and consult their registered investment advisor or financial advisor before making any investment decision.